Diploma of Advanced Studies (DAS)

Public sector economics│ECOP

The topic

The contemporary controversy about the relative merits of the State vs the Market—and implications as to which should be used to solve current societal problems—deserves to be debated with the aid of adequate tools. What reasons justify an intervention of the State? How can we design a role for the State that is compatible with market rules? Economic analysis can help us to understand the overall role of public authorities in the economy. One of the challenges is to understand how public spending, the regulation of economic activities, and the taxation system—among other elements—influence the decision to invest, to consume, and to work, etc. There are in fact numerous theories which justify—and condemn—State intervention as well as explain its modalities. The two principal conceptions of the State oppose one another: on the one hand, liberal economic theory suggests that the State should only intervene in case of a market failure; on the other hand, interventionist theory suggests that the State has a mission to stabilise the economy, to redistribute wealth, and to reallocate resources, and therewith to complete a wide range of other tasks.

Some of the documents for this course are available on the online Moodle platform. This tool offers students a platform for exchange; they can interact through it, and it can help them develop ideas about the public policies they have personally chosen to analyse.

If you are interested in applying for a place in the course on Public Sector Economics, why not try our self-evaluation test? By clicking on the link, you will find a short test which will rapidly let you know whether our course will meet your expectations. Ten self-evaluation questions await your answers!

- Master economic analysis tools in public finance;

- Identify the limits of traditional normative economic theory;

- Understand the contribution of positive economic theory in terms of public sector choices;

- Be able to analyse public policy using economic concepts.

- Students studying for the MAS in public administration (MPA);

- Students studying for the DAS in public administration;

- Leaders and managers in the fields of policy and administration;

- Executives in businesses and journalists.

Introduction aux finances publiques et à l’économie publique

Définition du champ d’investigation – Recettes et dépenses étatiques – Thèses explicatives de la croissance des budgets publics.

Instruments d’analyse des finances publiques

Eléments de microéconomie – Notions d’offre et de demande – Equilibre du marché et du consommateur.

Echecs du marché

Monopoles – Externalités – Biens publics – Réponse institutionnelle aux échecs du marché – Théorie des choix publics.

Financement des activités de l’État

Technique de l’impôt – Systèmes d’impôts – Imposition optimale.

Rôle macro-économique de l’État

Stabilisation de l’économie – Lutte contre le chômage – Lutte contre l’inflation – (Re)Distribution de la richesse.

Participants on this course have access to an Internet platform through which they can interact with each other and benefit from permanent, personalised follow-up from course staff. The platform is, in fact, far more than a simple online information or documentary library: students - in group - use it to design their coursework.

This involves participants selecting a societal problem of their own choice —for example, the lack of available land in Switzerland—and analysing not only the problem itself but also the possible role of the State. The knowledge gained during the course supports your analysis. The analysis of the problem is then guided by the key subjects covered in the course, week by week (public expenditure, public revenue, monopoly, externalities, etc.). In order to ensure that these subjects do indeed act as a guide for the participant’s analysis, the platform hosts a forum. In the days following each class, the participant must post his or her brief contribution to the forum and the participant receives a personalised commentary on the forum shortly afterwards. This process helps to create a group dynamic outside of the classroom, pushing work forward. Course participants have access to all forum contributions and to all personalised comments. By combining all of these elements, participants can pull together the definitive version of the course project work.

Elles·ils ont particulièrement apprécié......

- La présentation claire et objective des bases de l'économie;

- La maîtrise du sujet, le sens de l’écoute, l’élaboration et le corrigé des travaux de groupe;

- L’orientation vers les politiques publiques, le service public et les choix politiques;

- Les thèmes présentés avec une large ouverture d'esprit;

- Le degré de complexité tout à fait conforme à ce qu'un participant non économiste peut assimiler;

- La documentation riche et détaillée, la charge de travail tout à fait supportable;

- La plateforme internet permettant un excellent échange avec les autres participant-e-s et avec l'équipe d'animation;

- L'ambiance de cours agréable.

De façon générale, les participant·e·s recommandent le cours d'économie publique au plus haut point.

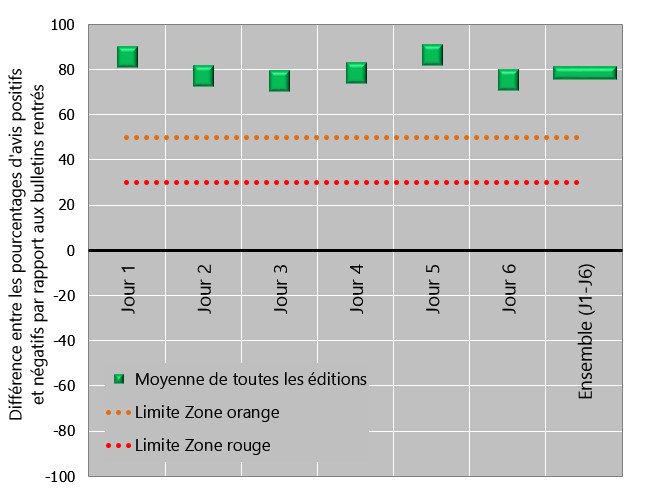

Evolution de l'indice de satisfaction au cours de journées :

Les personnes n'ayant pas de connaissance préalable d'économie nous demandent parfois quelle lecture préalable entreprendre pour se préparer au cours. Nous conseillons plutôt le livre de PARKIN M., BADE R. & GONZALEZ P. (2010), Introduction à la microéconomie moderne, Editions du renouveau pédagogique Inc. ERPI, Montréal, 4e éd. Vous pourrez m'en emprunter un exemplaire pour la durée du cours. Cet ouvrage pourra vous accompagner tout au long du cours.

Cela étant, ne lisez pas tout l'ouvrage avant le cours. Vous risqueriez de vous ennuyer ensuite ! Vous pouvez vous contenter de lire l'introduction et le chapitre consacré au 'fonctionnement du marché' (dans les grandes lignes).

Si vous n'avez pas de connaissance préalable, soyez également rassuré·e... vous n'êtes pas la première personne dans cette situation à suivre notre cours. Le cours est précisément aussi destiné à ces personnes là. Il est conçu pour que ces personnes ne perdent pas pied.

Il faut juste être ouvert·e d'esprit et accepter d'envisager le fonctionnement des relations humaines avec d'autres outils que ceux auxquels vous êtes habitué·e. S'il est une chose que je conseille de ne pas avoir au préalable, ce sont des préjugés vis-à-vis de l'approche des problèmes sociaux offerte par les sciences économiques.

Ouvrages de support au cours :

- HINDRIKS J. & MYLES G.D. (2013), Intermediate Public Economics, Cambridge: MIT Press

- SMEDO G., BENSAFTA M. & GAUTIER L. (2010), Economie des finances publiques, Ellipses, Paris

- WEBER L., ZARIN-NEJADAN M. & SCHÖNENBERGER (2017), Economie et finances publiques, Paris : Economica

Main teaching language

French

Dates, time, place

Every Tuesdays, from 19 September to 31 October, 2023 from 9.15 a.m. to 4.15 p.m., in the IDHEAP building.

Registration deadline

To be confirmed

I want to register

The registration link for 2024 will be available in April 2024. The number of participants is limited and registrations are processed on a first come first served basis.

Registration fees

Total course registration fees come to CHF 3,900 (including all documentation), which should be paid on receipt of the invoice, and by the start of the course at the latest.

A discount of 5%, up to a maximum of CHF 500 per course, is available to any IDHEAP alumni—holding an MPA, DAS or CEMAP, an IDHEAP PhD or a Master’s in PMP—who wish to follow a CAS course or a Seminar for Specialist and Executives organised by IDHEAP. This reduction does not apply to participants in the DAS who subsequently wish to follow the MPA course. Any decision to withdraw from the course must be made in writing. If withdrawal from the course is announced between 21 and ten days prior to its commencement, 50% of the registration fee will remain due. If withdrawal from the course is announced less than ten days before its commencement, the entire registration fee is due. The number of places being limited, registrations will be considered on the basis of the date of receipt.

Course Manager

Prof. Olivier Schöni

+41 21 692 68 70

Olivier.Schoni@unil.ch

Studies Secretariat

Fatma Yavavli

+41 21 692 69 17

mpa.idheap@unil.ch